Guide to Mobile Device Security and Identity Theft Prevention

The security of your financial information is one of Dieterich Bank’s most important responsibilities. We maintain our Internet banking platform using stringent information security guidelines and use many lines of defense to protect your account information. From passcodes, dual authentication, SSL, encryption software, high-end firewalls, and automatic log off, your information is always protected. In this article, we’ll cover best practices for mobile device protection to help you protect the sensitive information stored on and transmitted by your smartphone, tablet, laptop, or wearables.

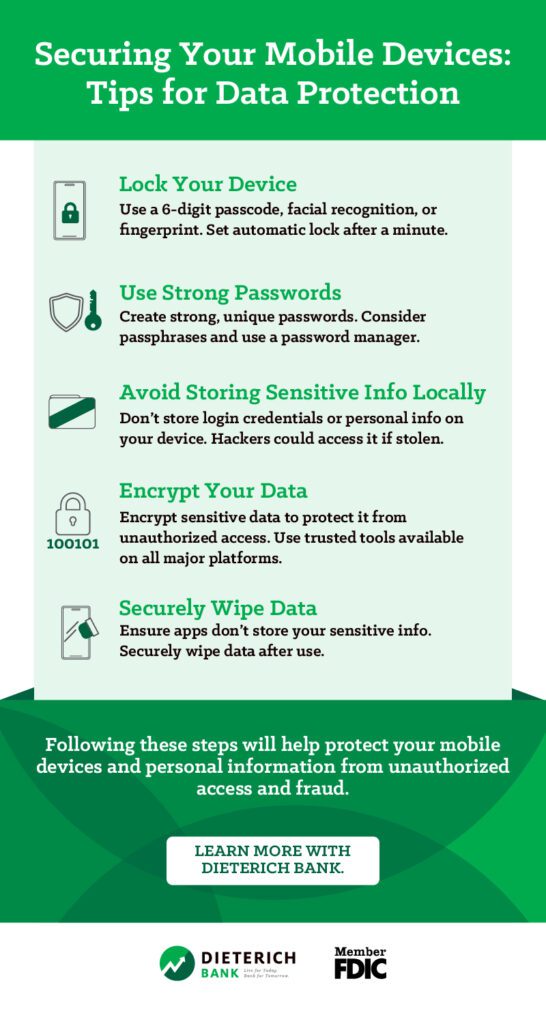

Tips For Securing Mobile Device Data To Prevent Fraud

Do you sometimes feel like your whole life is inside your phone, tablet, or laptop computer? It’s not an exaggeration. From digital calendars to photos, text messages, email, and other apps, your devices are full of your personal data. This is why they are such an attractive target for hackers and scammers. Learn how to protect your mobile device data from fraud and identity theft.

Lock Your Phone

Using a 6-digit passcode, facial recognition, or finger print along with automatic locking of your phone after a minute or two can prevent easy access by a thief.

Use of Pins and Passwords

A strong password is one of the most important ways you can protect the security of your mobile device apps.

- Create strong, unique passwords.

- Do not write your credentials down.

- Don’t share your login information with others.

- Use unique passwords for each account.

- Use passphrases rather than passwords, such as a series of random words or an unpredictable sentence. Passphrases can be easier for you to remember, but tougher for an attacker to figure out.

- Consider using a password manager to create and store login credentials for you if it’s too difficult or burdensome for you to remember different passwords on your own.

Avoid retaining unnecessary sensitive information on devices

As tempting as it may be for convenience’s sake, don’t store login credentials and other personal information such as mailing addresses in a browser or locally on your computer or phone. Not all browsers store usernames and passwords securely. Information saved locally could be accessed by hackers if your device is lost, stolen, or compromised by malware.

Encryption of any sensitive information stored on devices

While “encryption” may seem like a complicated process that only a professional IT person could figure out, anyone can encrypt their data, it’s not just for the tech-savvy. Simply put, encryption means converting your sensitive data into a code that is only accessible to authorized users. This prevents unauthorized access in the event of theft or other compromise of your devices. Take advantage of the tools available to make encrypting your device a painless process. Whether you are on an Apple, Microsoft, or Android operating system, there are trusted open source tools for data encryption that can be of help. Learn more:

- Apple Encryption and Data Protection overview

- Encryption for Android devices

- Encryption and data protection in Windows

Securely wipe sensitive information from device memory upon exiting applications

Dieterich Bank’s mobile banking app doesn’t store your sensitive information temporarily or permanently. However, other apps you use may require a secure wiping of information after you leave the app. Read more about wiping personal data in this Consumer Reports article.

Use multi-factor authentication whenever possible.

Also known as two-factor authentication, this simply means providing an additional login credential besides your username and password. This could be a temporary passcode sent to you via text message or email. Other types of credentials include fingerprint authentication, face ID, and phone calls. More and more accounts now require multi-factor authentication, but you should opt in even when not required to better secure your personal data.

Quickly de-register a device if lost or stolen

Luckily, there are tools available to help you protect your personal data by locking or erasing your device remotely. Choose one that you trust and that is reputable. It’s also a good practice to find similar tools that make old, unused devices unreadable. Learn more:

- Google Account help

- Erase a device with iCloud

- Search for and compare anti-theft software for different operating systems.

Small business apps

If you are a small business owner looking to develop a new app, due your diligence when hiring developers. Ask to make sure they are following best practices for mobile app security and secure coding practices. This includes testing for vulnerabilities and having the ability to patch quickly.

Follow these tips for safely downloading mobile apps

- Only download apps from official or trusted app stores such as the Google Play Store, Apple App Store, Samsung Galaxy Apps, and more.

- Read the privacy policy. Yes, that’s right–don’t skip over the fine print this time. It’s important to know how personal information will be accessed and used. If there’s no privacy policy, that’s definitely a red flag.

- What permissions is the app asking for? Be careful about granting access to features such as your location, contacts, camera, etc.

- Keep your apps up to date. Periodically review your apps collection to delete any you are no longer using and ensure the ones you do use are updated.

These tips also apply to safely downloading app patches or updates.

Install malware protection software on your devices

Short for malicious software, malware can take the form of computer viruses, trojan horses, or spyware. To protect your devices, install a reliable antivirus program and periodically scan your device for spyware. Also, be cautious about clicking on links in emails, text messages, or websites. Scammers may be trying to trick you into giving away personal information or clicking on a malicious link.

Learn how to recognize smishing messages

A play on the concept of “phishing messages,” smishing is when those scam messages arrive via text message or SMS. Smishing has become increasingly common because there is no spam filter or other line of defense to prevent scammers from sending text messages. Before responding to a message or clicking on a link, follow these tips:

- Delete text messages from numbers or email addresses you don’t recognize.

- Remember that financial institutions and legitimate companies will never ask for personal or account information over text.

- Don’t click on links you weren’t expecting to receive or that come from unknown senders.

- Keep in mind that smishing messages can also arrive over other messaging and social media apps, not just text messages.

Risks of public WiFi

Do you frequently use public WiFi at coffee shops, airports, and more? Open networks are less secure than password-protected ones. Scammers will exploit these vulnerabilities to gather sensitive information such as login credentials, financial info, personal data, and more from devices connected to public WiFi. So, avoid logging into financial accounts or shopping online while using public WiFi unless you have a VPN (Virtual Private Network) to keep your online activity hidden from prying eyes.

Dieterich Bank is here to help!

While online banking is safe, as a general rule you should always be careful about giving out your personal financial information over the Internet. Most cybercrime occurs from users providing their credentials or personal information to online contacts they thought they could trust. Learn more about how we protect your information and our digital branch tools. If you have questions or would like to speak with a member of the team to learn more, you can contact us at 800-699-9766 during regular business hours or Falcon Fraud Center at 855-293-2456.