While many people make New Year’s resolutions they might struggle to keep, a January financial checkup is the kind of goal that pays dividends all year long. Now that the holiday rush is over and tax season is coming up, it is the perfect time to pause, reflect, and clean up your banking habits.

To help you hit the ground running, we’ve put together a six-point checklist. With our digital tools and local support, we make it easy to start your year with total financial clarity.

1. Audit Your Recent Statements

While December is often a blur of holiday shopping and travel, January is the time to look at the data. Take a close look at all your financial accounts, including your bank and credit cards.

Don’t just skim over this information; examine every transaction and look for unauthorized charges, duplicate transactions, and subscription creep. If you find any transactions that you don’t recognize, figure out whether you really made them. If you find evidence of fraud, report it as soon as possible.

Many people sign up for streaming services and other subscriptions that they keep paying for whether they really use them. These costs can add up, especially as they continue to rise over time.

You should also look for spending patterns from last year such as underused services, impulsive spending, and excessive use of ride shares, food delivery, or dining out. A review can give you an idea of how they impact your finances in 2026.

Tip: Switch to eStatements for easier tracking and added security. With eStatements, you won’t have to worry about someone pilfering your statements out of your mailbox or getting lost in the mail. You’ll no longer have to shred your paper statements before throwing them in the trash, and it’ll be easier for you to review your finances at any time.

2. Streamline Auto-Payments & Subscriptions

Did you sign up for a trial membership in December that you forgot to cancel? Or perhaps you have a gym membership or supplement delivery that no longer fits your 2026 goals?

Review your recurring apps and services. If you’re managing multiple accounts or payment methods, you could consolidate your payments so they’re easier to keep track of and to see how they’re impacting your budget.

Bonus: Use mobile banking to set alerts when these expenses hit your account. This is a convenient way to remind yourself of regular expenses so you can better keep track of them and consider whether you could live without them.

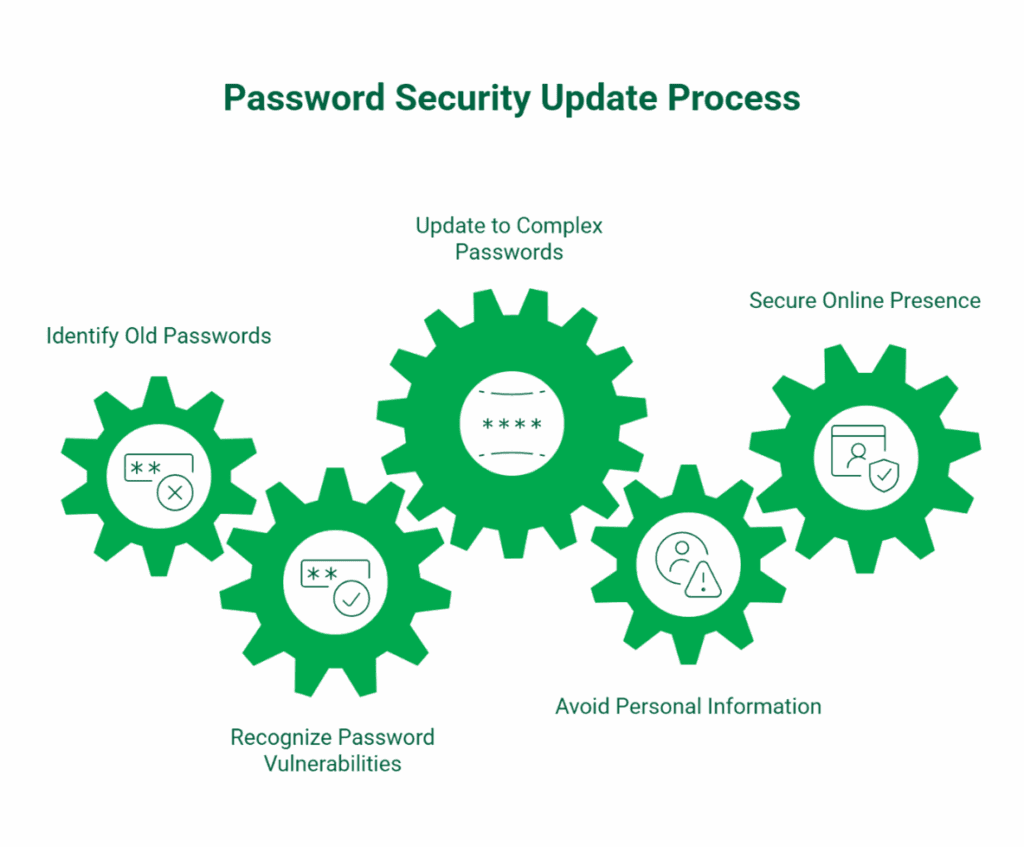

3. Refresh Your Account Security

If using the same password for a year or more and reusing passwords on multiple accounts seems convenient for you, imagine how much easier it is for cybercriminals to hack into your accounts. Using the same password more than once is like creating a skeleton key for hackers because they would only need to break into one of your accounts to access the others.

Change your old passwords and update them to more complicated ones. A pet’s name, something with your address, or the names of family members or your job are the kinds of passwords that criminals love because they can find that kind of information online, using Internet searches, social media, and artificial intelligence.

This can also make it easier for scammers to guess your security questions. If you post your dog’s name on social media and use that name as one of your security questions, that’s an open invitation for hackers to change your password and break into your accounts. Review all your security questions and consider switching your answers to ones that would be easy for you to remember, but hard for someone else to discover.

Set up multifactor authentication for each of your accounts, where you would have to approve any logon attempts through an app on your phone or a code that you receive via text or email. This way, even if someone hacked into or guessed one of your passwords they still couldn’t access one of your accounts without your approval, or if they also had access to your phone or email.

Consider using a password manager to add an extra layer of account security. This way, you would only have to remember one password for the password manager itself while it would create complex passwords for your other accounts, store them in the cloud, and enter them for you through an app on your phone or a browser extension on your computer. The password you use for your password manager should be something complicated enough to keep hackers away, but easy for you to remember. Adding multifactor authentication to your password manager would make your accounts even more secure.

You could also implement Card Controls on your debit and credit cards to limit your spending by location or amount and to lock your cards when not in use.

4. Set Your 2026 Financial Intentions

Now that the previous year is in the books, ask yourself a few key questions to guide your strategy for the months ahead:

Did I save more than I spent this year?

While your bank statements offer the most obvious example of your financial bottom line for the year, “saving” means more than just having some funds left over at the end of the year. It also includes whatever you contributed to your retirement funds (401(k), IRA, etc.). It could also mean whatever you set aside for a designated purpose, such as an education fund.

Was my emergency fund enough?

Financial experts recommend that every household have at least two to three months’ worth a living expenses set aside as an emergency fund, preferably in an account that you could access at any time while also earning interest. Of course, your own financial needs may vary. If you’re the primary or sole breadwinner with a family to support, or if your income fluctuates throughout the year, you might need more in your emergency fund.

This is why a new year bank check up is so important. It gives you a chance to figure out how much you actually need to live on and whether your emergency fund could cover your expenses if you were laid off or had an unexpected bill, such as repairing or replacing a vehicle or a major appliance.

If any of these things happened to you over the past year, did you have enough set aside when you needed it? If you didn’t, you’re not alone. A survey by the Federal Reserve in 2024 found that 63% of adults said they could cover a $400 unexpected expense, while 37% said they would have to borrow money or sell something to cover that bill, and 13% so they wouldn’t be able to cover that expense at all. A different Fed survey found that 55% of American adults had three months’ worth in their emergency fund in 2024.

Not having enough in your emergency fund means that any unexpected expense could put you further behind, especially if you must cover it through borrowing, such as a credit card. If it takes you a while to pay off the balance, the interest costs could really eat into your budget.

If you need to increase your emergency fund, or if you don’t already have one, try setting aside a little bit each week or month. When it comes to your emergency fund and savings overall, it can help to automate the process by having funds transferred into a designated savings account regularly, such as a portion of every paycheck or at the end of each month.

Am I being intentional with my money or reactive?

Many people are reactive with their funds, making their spending decisions impulsively without a clear plan or a budget. This makes it hard for them to save for the future and to meet their goals.

Being intentional with your money means putting together a realistic budget with clear goals in mind. Take the time to evaluate your needs and wants and create a plan to accomplish your goals. They may include saving up for a major expense, such as buying a home, or setting funds aside for retirement and/or a college fund. If you really want to achieve these goals, it’ll take time and planning to do so. Not only can this give you a clear path to success, reviewing your budget throughout the year serves as a reminder to keep you from spending impulsively.

Am I proud of where my money went?

This might seem like an odd thing to consider in your annual financial checkup, but it’s worth considering. You might be glad that you supported a particular charity or helped out a friend or family member with a financial need. You might be less enthusiastic about any impulse buys for something you didn’t really need, or food deliveries you could have done without. Many people cringe at how they spent some of their funds over the year, so don’t beat yourself up over this. Just try to learn from any mistakes and keep this in mind for the future.

What habits should I emulate this year—and which ones hurt?

Whatever funds you managed to save over the past year, or debts that you reduced or eliminated, are reasons to celebrate, as these activities improve your financial well-being. If you’ve increased any high-interest debts (such as credit cards or personal loans), that’s something to reflect on so you can try and avoid that in the future. It’s also a reminder of the importance of being mindful about your spending habits and having enough in your savings account to get you through a financial dry spell or to meet an unexpected expense. If you’ve dipped into your emergency funds for an unnecessary or frivolous expense, make a goal of avoiding that in the future.

Tip: Keep your answers to these questions in a digital note. Next January, you can look back and see how much progress you’ve made.

5. Build Your 2026 Spending Strategy

Use what you’ve learned from your “new year bank account checkup” to create better category spending limits. Consider these ideas as you evaluate the past year and look to the future:

- Set your 2026 savings goals (emergency fund, travel, down payment, etc.).

- Consider automating savings transfers or scheduling bill payments.

- Visit our Online Banking portal to create or adjust recurring transfers.

6. Get Ahead of Tax Season

January is the “calm before the storm” for taxes. By organizing now, you avoid the April scramble:

- Making sure your accounts are categorized correctly. If you run your own business or are an independent contractor, you’ll need to make sure you separate your business and personal expenses. You should also make sure any contributions to a health savings account or an individual retirement account are adequately documented and labeled.

- Save and gather your receipts or digital records for deductions (donations, childcare, medical).

- Download your year-end 2025 statements now and have them ready when your tax preparer asks for them.

- Schedule a review with a Dieterich Bank banker to optimize your setup.

Make your Financial Health a Resolution You Keep

Many people resolve to hit the gym, but your financial health is just as vital to your peace of mind. Whether you stick with that plan is up to you, but your new year account check up and responsible budget plan are keys to your financial health that shouldn’t be overlooked.

A 30-minute account review can prevent hours of stress later and help you lead a happier and more prosperous life. Whether you’re building on a strong 2025 or planning a financial comeback for 2026, Dieterich Bank is here to support your financial wellness every step of the way.